That's MY $700 Billion

I just want to share a little of what I’ve been reading, because I find it interesting.

For example, consider Bloomberg’s take on the candidates’ reactions to the latest financial news (namely, the $700 billion proposed bailout of the entire financial sector). Here’s a representative snippet:

[Bill] Donaldson, who was tapped by Bush to head the SEC, says Obama called him last year about the financial-regulatory problems. He has never heard from McCain.

“Obama has been talking about the need for better financial regulation well before this crisis hit and has done some real thinking about it,” says Donaldson, a lifelong Republican. “McCain comes across as someone who suddenly realized changes have to be made.”

Additionally, they compare the people that Obama and McCain turned to for advice. Both of them turned to three people for advice. Obama called three former Treasury Secretaries. Two are described as particularly effective (Rubin and Summers), and the third became a well-regarded chairman of the Federal Reserve (Paul Volcker — described as “towering”). McCain, on the other hand, called a Reagan administration adviser (Martin Feldstein) who was regularly cut out of the decision making process by Reagan’s chief-of-staff, a former undersecretary of the Treasury not known for doing much (John Taylor), and the former CEO of HP who was fired rather publicly and received $21 million from the golden parachute clause in her contract (Carly Fiorina). Bloomberg clearly prefers Obama’s choices.

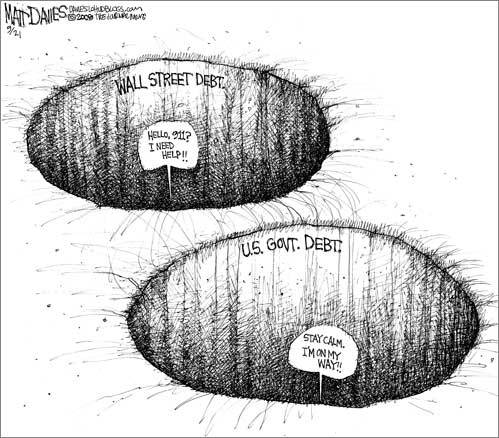

And just when you thought fiscal conservatives would be mad enough about the government buying AIG ($75 billion) and bailing out Fannie Mae and Freddie Mac ($25 billion) and bailing out Bear Stearns so that JPMorgan would buy it ($29 billion), now comes the Big Bailout. Let me reformat that: the BIG BAILOUT. An order of magnitude bigger. The taxpayer is now on the hook for an additional seven hundred billion dollars. Let’s put that in perspective: according to President Bush’s budget, we’re expected to spend $659 billion on the oh-so-odious Social Security in 2008. The US Government total 2008 budget tips the scale at 2.931 trillion dollars, according to the Heritage Foundation, which means this bailout would be TWENTY THREE PERCENT OF OUR ANNUAL BUDGET!!! Imagine if a guy that makes $100k/yr (which amounts to $77k/yr after taxes, i.e. $6,416/month) suddenly had to spend $17,710. That’s what we’re talking about. Are you screaming yet?

Jared Bernstein has an article in the Huffington Post. Here we go:

You hear that implosion reverberating through financial markets? It’s the sound of decades of conservative ideology collapsing. … The week that just ended revealed the myth of market fundamentalism: the notion associated with mainstream, Milton Freidman’esque economics, and amplified by anti-government conservatives that unfettered markets will provide society with the best outcomes. Such simplicity, such elegance…such nonsense.

He has a list of what he calls “glaringly obvious truths” that I think is very worth reading.

Since you probably won’t go read that article, here’s a few key ones (and my reactions):

- Deregulated markets cannot police themselves; they tend toward speculation, vastly underpriced risk, and deeply damaging bubbles; (sounds accurate to me, given what we’ve seen; or perhaps it’s more accurate to say that deregulated markets DO NOT police themselves, even if they can)

- An economy that generates growth while leaving most families behind is a broken economy (ok)

- We can neither achieve broad prosperity nor compete globally without robust growth in key sectors which we have ignored or underfunded, including manufacturing, green production, and cradle-to-retirement public education; crafting evermore clever financial instruments will not pave the way to dependable, broadly shared growth (translation: creative accounting is no substitute for good fundamentals)

- No private sector firm should be too big to fail; any firm of that magnitude must be nationalized (I would say, rather than nationalized, “broken up”, but the question becomes: at what point do we know that a company is too big? And what kind of a disincentive for smart business practices does this become? It’s fun to say that too big is bad, but is the cure worse than the disease?)

- Capital markets are dysfunctional; borrowing and lending standards are ignored; lax capital requirements lead to constant over-leveraging; shadow accounts thwart transparency (that’s not a truism, that’s describing the current situation)

- We apparently can quickly find (or borrow) the money to do the stuff the authorities deem necessary, be it war or bailout; thus, we can also find the money we need for investment in people, from health care to education to infrastructure, etc. (typical complaint… and saying “we don’t have the money” is obviously a poor excuse. These discussions should go back to “should we do this”)

There’s more, but those are the most central to his point.

Is he saying that capitalism can’t work? Maybe. I disagree with such an extremist statement. But consider this: the current Treasury Secretary Paulson (whatever you think of him) said about this crisis: Raw capitalism is dead.

Another fellow, named Robert Borosage, puts it slightly differently in his article:

Call it extortion. Every American is now being told to ante up $2000 — an estimated $700 billion in all — to bail out the banks from their bad bets, or they’ll bring down the entire economy.

In the speculative frenzy that allowed the Masters of the Universe to pocket millions personally, the banks filled their coffers with toxic paper that no one wants to buy. Now they sensibly don’t want to lend money to each other, since no one knows if the other is solvent. So they go on strike, and threaten to trigger a global depression, if they don’t get rescued.

He then lists seven of his own suggestions, which are also worth reading. Granted, I don’t see how his fourth suggestion (curb excessive CEO pay) would do much more than make us all feel better, but the heart of the matter is: these guys ran their companies, along with anyone who depended on them, into the ground. They shouldn’t be allowed to profit. The government’s bailout money should, if used at all, be only used to keep the economy afloat. CEO golden parachutes should be considered just as forfeit as if the company went bankrupt. Because that’s what these companies are: BANKRUPT.

Does nobody else in the world get chills down their spine from just uttering that word?

I still want to know just what would happen if these companies were simply forced to sleep in the beds they’ve made for themselves. If AIG did such a bad job, what would happen if they simply went belly-up? Wouldn’t other folks in the market be forced to realize that they really DO need to perform due diligence? That there’s a REASON things are called risky? So people get fearful, so credit starts to be harder to get, so people stop investing in things they don’t understand… isn’t that a good thing? The fundamental problem here, that started this whole mess, is that they were being too free with the credit and loaned money to anyone with a pulse and never bothered checking whether it was a good idea to loan them money! Credit should be harder to get! People who can’t afford a house shouldn’t be buying one! And if you don’t know how risky an investment is or if you don’t understand where the return comes from DON’T BUY IT! There’s a shocking idea for you…

These people deserve to lose lots of money for making stupid decisions, and anyone who loaned those folks money (aka investors) won’t be getting it back. But we don’t want some sort of cascade to happen where nobody invests in anybody ever again. How can we make people learn their lessons without taking the stock market down with them? There are a lot of ordinary folks in the stock market these days, including ones that may not even realize it, due to their retirement accounts: the day of the pension has passed, and 401k’s rule the land. When the market goes down, they take the little guys with them.

Buying all of these bad investments, such that they now become OUR bad investments, seems like a bad idea (no matter whether it’s the government doing it or our mutual fund managers). What do we-the-people want with bad investments? We don’t! And yet, this bailout seems more like, as Bernstein puts it: privatizing the profits and socializing the losses. Oh goody, sign me up for that! You notice all the pro-deregulation folks are lining up behind this bailout, don’t you? It’s called voting yourself money. It’s also called “saving your own hide”… at everyone else’s expense.